In investing, the breakeven point is the point at which the original cost equals the market price. Meanwhile, the breakeven point in options trading occurs when the market price of an underlying asset reaches the level at which a buyer will not incur a loss. The breakeven formula for a business provides a dollar figure that is needed to break even. This can be converted into units by calculating the contribution margin (unit sale price less variable costs).

What is the break-even point for a business?

- Otherwise, the business will need to wind-down since the current business model is not sustainable.

- Break-even analysis works well for short-term planning, like setting immediate sales goals or dedication to prices.

- Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

- Another very important aspect that needs to address is whether the products under consideration will be successful in the market.

One common situation involves deciding the maturity of the bond you want to buy. Typically, bonds that mature further into the future offer higher rates than those that mature sooner. But if you think interest rates will rise, then you might prefer to take a lower rate now in exchange for being able to reinvest at a higher rate sooner in the future. In this case, the break-even interest rate will tell you how far prevailing rates would need to rise by the time the shorter-term bond matures in order to make up for its smaller interest payments. If you’d prefer to calculate how many units you need to sell before breaking even, you can use the number of units in your calculation. Here are four ways businesses can benefit from break-even analysis.

Why Is Breakeven Point Important?

Revenue is the price for which you’re selling the product minus the variable costs, like labor and materials. For instance, if management decided to increase the sales price of the couches in our example by $50, it would have a drastic impact on the number of units required to sell before profitability. They can also change the variable costs for each unit by adding more automation to the production process. Lower variable costs equate to greater profits per unit and reduce the total number that must be produced. The total fixed costs are $50k, and the contribution margin ($) is the difference between the selling price per unit and the variable cost per unit.

Break-even analysis example

So, after deducting $10.00 from $20.00, the contribution margin comes out to $10.00. Typically, this analysis works best for businesses that focus on a single product or service. The analysis becomes more complex and less accurate if you offer a wide range of products with different price points and variable costs. For example, If you sell both high-end electronics and low-cost accessories, a single break-even analysis won’t account for the differing profit margins. You’d need individual analyses for each product category to get a more accurate picture of your profitability. It’s one of the biggest questions you need to answer when you’re starting a business.

The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation. Financial terms and calculations includes revenue, costs, profits and loss, average rate of return, and break even. If you won’t be able to reach the break-even point based on your current price, you may want to increase it. Increasing the sales price of your items may seem like an impossible task. For many businesses, the answer to both of these questions is yes.

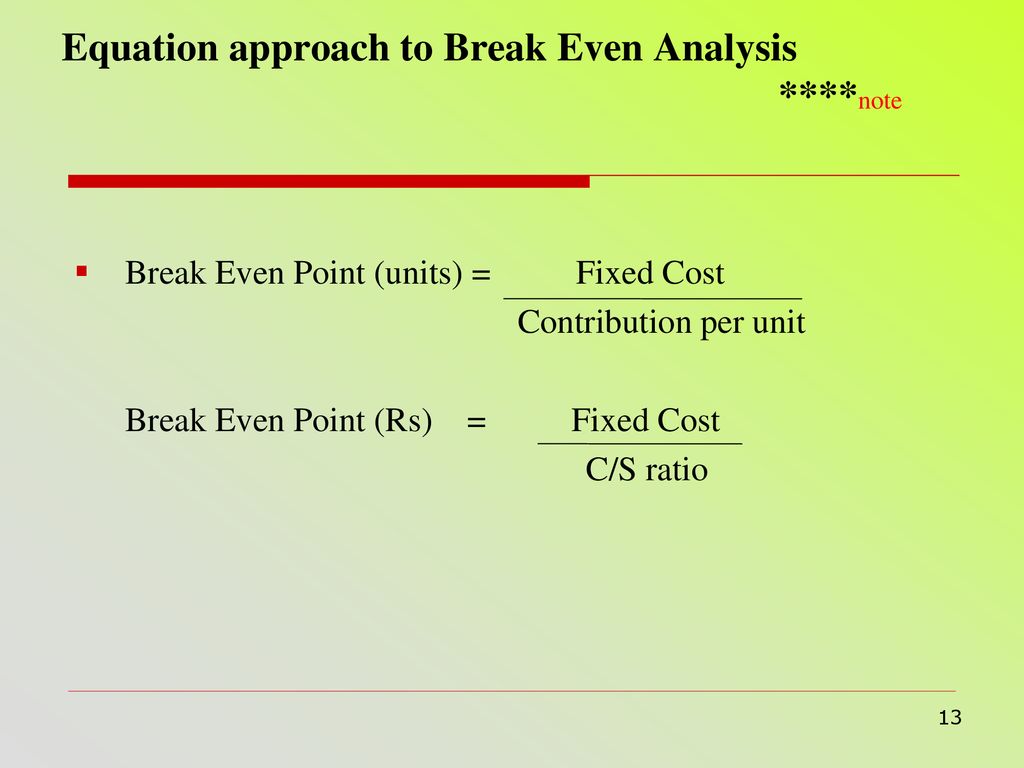

The contribution margin represents the revenue required to cover a business’ fixed costs and contribute to its profit. With the contribution margin calculation, a business can determine the break-even point and where it can begin earning a profit. Now, as noted just above, to calculate the BEP in dollars, divide total fixed costs by the contribution margin ratio. Break-even electronic filing is the point at which revenue and total costs are the same, meaning the business is making neither a profit nor a loss. The break-even level of output informs a business of how many products it needs to sell to reach the break-even point (BEP). Using break-even allows a business to understand its costs, revenue and potential profit to help inform business decisions.

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. Using the algebraic method, we can also identify the break-even point in unit or dollar terms, as illustrated below.

Fixed Costs – Fixed costs are ones that typically do not change, or change only slightly. Examples of fixed costs for a business are monthly utility expenses and rent. Barbara is the managerial accountant in charge of a large furniture factory’s production lines and supply chains. She isn’t sure the current year’s couch models are going to turn a profit and what to measure the number of units they will have to produce and sell in order to cover their expenses and make at $500,000 in profit.

Under the accrual basis of accounting, revenues are recorded at the time of delivering the service or the merchandise, even if cash is not received at the time of delivery. Insurance Expense, Wages Expense, Advertising Expense, Interest Expense are expenses matched with the period of time in the heading of the income statement. Under the accrual basis of accounting, the matching is NOT based on the date that the expenses are paid. Once you calculate your break-even point, you can determine how many products you need to manufacture and sell to make your business profitable.